[High-growth Strategy] Enterprise high-growth portfolio model and 12 growth opportunities in the future

Mr. Joseph Poon & Dr. Mark Lee

Corporate Mindset and Culture are the cornerstones of performance growth

McKinsey research found that the most important technologies for high-growth are actually Mindset and Organization Culture. Enterprises that do well in these two aspects often have high growth, including brand, customer experience, scientific and technological products, etc. Until 2005, the Hang Seng index was positioned as a cost center because its internal culture was a culture of serving the society and paid more attention to risk avoidance. After the new president took over in 2005, he proposed a positive culture. There is no need to be too conservative and try to be more aggressive. Taking advantage of the strong growth of global index ETFs , the Hang Seng Index has been explored and adjusted position, and different indexes with trading potential in the market are designed for target customer groups . By 2021, there are more than 100 ETFs related to the Hang Seng Index , with an amount exceeding US$ 42 billion.

Is there a way to achieve high performance growth?

High growth is not only a choice, but an inevitable requirement of enterprises. But is there a way to achieve high growth?

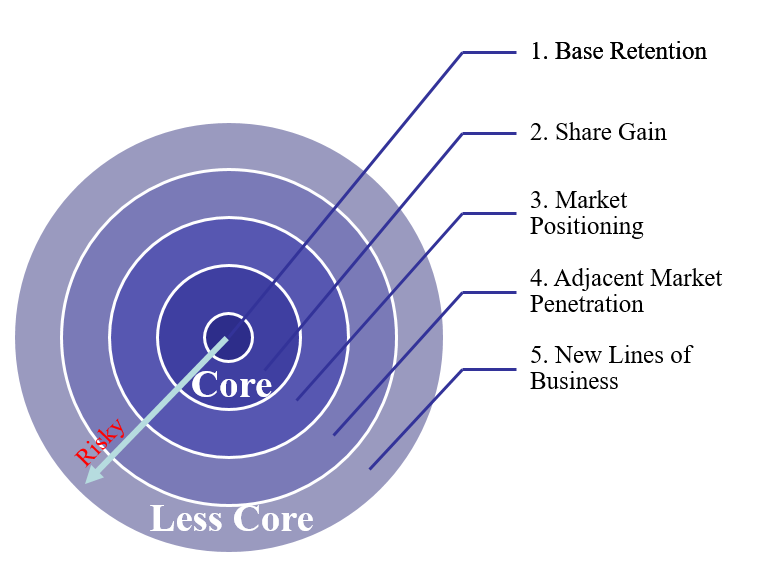

All industries and companies go through growth, maturity and retrogression. This is an inevitable law. If you do not constantly look for high-growth engines, your business will decline. In fact, there are ways to find high growth. According to t the Revenue Growth Portfolio (RGP) model, growth has five dimensions: Base Retention (retaining its own growth based on core competitiveness), Share Gain (capturing the market share of competitors), Market Positioning (Aim at segmentation to expand the market), Adjacent Market Penetration (near market penetration associated with core competitiveness), New Lines of Business (seeking new business). In the entire growth portfolio, companies must focus on the core competitiveness of the company. The more outward growth methods and core competitiveness are less viscous, the higher the risk.

All industries and companies go through growth, maturity and retrogression. This is an inevitable law. If you do not constantly look for high-growth engines, your business will decline. In fact, there are ways to find high growth. According to t the Revenue Growth Portfolio (RGP) model, growth has five dimensions: Base Retention (retaining its own growth based on core competitiveness), Share Gain (capturing the market share of competitors), Market Positioning (Aim at segmentation to expand the market), Adjacent Market Penetration (near market penetration associated with core competitiveness), New Lines of Business (seeking new business). In the entire growth portfolio, companies must focus on the core competitiveness of the company. The more outward growth methods and core competitiveness are less viscous, the higher the risk.

Mohawk, a carpet manufacturer, operated independently from its parent company Mohasco in 1988 , and went public in 1992 . At the time of listing, the turnover was only 300 million US dollars, and the market share was only 3% . From 1997 to 2002, the average annual growth of turnover was 12.4% , gross profit increased by 17.2% , and net income increased by 29% . By 2003, the turnover reached 4.2 billion. Mohawk ’s high performance growth stems from the following portfolio strategies:

- Base Retention: enhancing the relationship with distributors and "make distributors happy", that is, let distributors profitable. For example, improving product quality, ensuring that styles meet customer needs, optimizing logistics services, investing in shop floor decoration, and allowing customers to feel the carpet in the shop. According to the characteristics of each retailer, they launched targeted products to make each retailer competitive.

- Share Gain: extend from the medium and high-end carpet product line to the medium and low carpet market, meet customers' needs with low-cost production and supply, adopt a strategic model similar to ZARA strategy mode, open the " Home-Fashion " strategy, and supply different types of carpets according to customers' indoor environment. And ensure that the entire supply system smoothly, so that it can occupy the market twice the average growth rate of the market, and the market share has increased from only 3% to 28%.

- Aim at segmentation to expand the market: In 1999, it was recognized that "environmental protection" was the trend. It acquired environmental protection manufacturers, occupying the monopoly market of recycled plastics and launched environmental protection carpets. And jointly with well-known brands, launch sub-brand products, and use multiple products and multiple brands to meet the demands of brand owners.>

- Adjacent Market Penetration: Based on the advantages of channels and networks, artificial plastic flooring and ceramic tiles are launched through outsourcing production mode or acquisition mode, focusing on products on the ground.

What are the differences in the performance growth points of different industries?

In certain industries with very high customer concentration, the top few customers often occupy the company's main performance. In ensuring its own growth, risk management is more important. If there is a loss of a certain top customer, it may hit 30%-40% of performance. Therefore, for this type of company, it is necessary to constantly review its value proposition and maintain continuous value transactions with existing customers, which is the key to steady growth.

For industries with a very wide range of customers, we should not simply divide the market with products, but more from the perspective of users. For example, banks have a very large customer base, and KYC is also the first to do it. Understand customers, segment customers, build customer value models, cover customer contributions, maintain customer relationship costs, transaction costs, customer loyalty, etc., calculate customer profit contributions, and then find customer segments with high-value contributions. The customer value model also needs to fully consider the customer's lifetime value. In addition to borrowing needs, customers also have needs for trade financing, cash management, deposits, etc. If in the actual process, the number of cross-transactions for each customer is very low, it is far from enough. And if the number of cross-transactions does not continue to rise, it is necessary to reflect and reconstruct the customer value model.

The most basic market segments for banks include: global finance, industrial and commercial financing, SME banking and personal finance. Each market is totally different business model to operate, such as industrial and commercial financing and more focus on customer relationships, with 1 customer manager to run 10 or 20 industrial and commercial customers, but obviously cannot use this model to operate more than 20 million for Small and medium enterprises.

How to find value-added points based on customer value proposition?

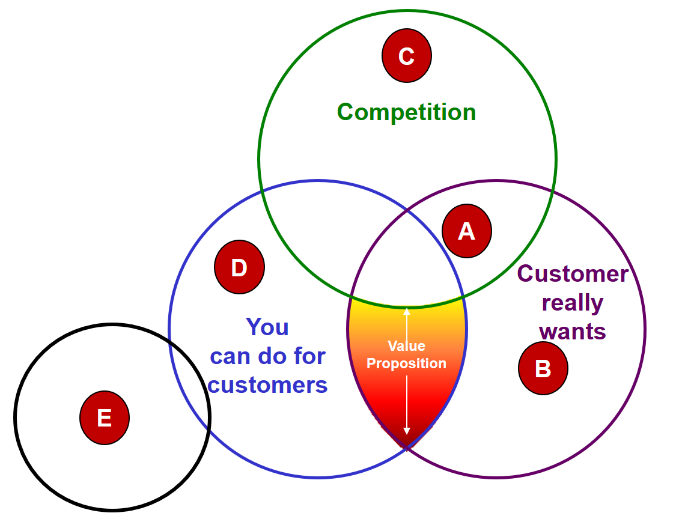

How to penetrate into the adjacent market related to core competitiveness was also encountered by HSBC and Hang Seng in that year . Throughout the strategic discussion process, based on the customer value positioning model, the key points of growth are gradually derived.

How to penetrate into the adjacent market related to core competitiveness was also encountered by HSBC and Hang Seng in that year . Throughout the strategic discussion process, based on the customer value positioning model, the key points of growth are gradually derived.

- The company must first realizes that, competitors of some business ( A ) are not banks, but private banks and insurance companies.

- Secondly, discuss the current customer market ( Value Proposition that the company can obtain, but the competitors have not entered. Is this market a high-value market? If the market entered is a market where opponents can give up and are low-profit, the company will always struggle in pain.

- How to capture customer unmet needs ( B )? It is found that in the entire SME market, banks need to establish a business banking under industrial and commercial finance to promote SME services and improve the transaction convenience and security of SMEs. For example, in cooperation with Octopus, more than 10000 SMEs receive and pay through Octopus.

- How to expand the customer market for the unaffected core competitiveness ( D )? For example, AAC Technologies started with acoustics, and continues to invest 6-7% of its annual sales in R&D, increasing cross-trading and revenue on the same customer through "touch feedback" and "optical" .

- How to jump out of your business, new business development ( E )? In 1949, Honda mainly produced motorcycles and was very successful. At that time, the managers recognized that that Honda's core competence was the excellent ability to manufacture small internal combustion engines. Based on this core competence, they launched different products, such as grass-producing machines, generators, and light commercial jets, etc.

Does the double-digit value-added of the enterprise prove to be safe?

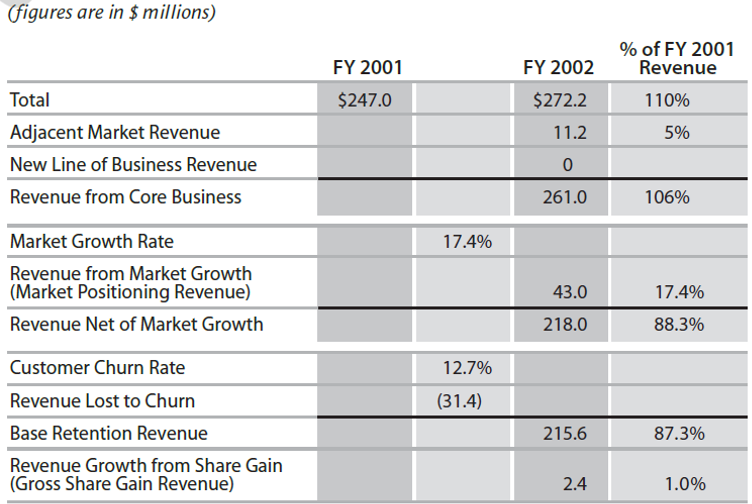

When business managers look at the annual performance report, the most relevant information is: how much has it increased this year? But even if this growth is higher than the industry average, it is not necessarily high growth. When you refine the income growth into the income growth portfolio ( RGP ) model, you will have different findings , even hindsight and cold back.

There is a medical and health company, it increased by 10% in 2002 compared with 2001 , and there is also a double-digit value-added. From the perspective of the five -dimensional growth combination, the market share rate reached 17% , and the adjacent market was also done well, revenue increasing by 5% . However, in Base Retention, the loss of basic customers is very serious, and business growth is more derived from the market for non-core capabilities rather than the market for core capabilities.

The above cases fall into a typical management blind zone: non-core growth masks the fatal problems of core business. At this time, such a company must reconsider its core capabilities and market positioning. Otherwise, when the growth of non-core businesses is blocked and the core business is no longer competitive, the company will enter a period of rapid recession.

Where is the growth trend in the next decade?

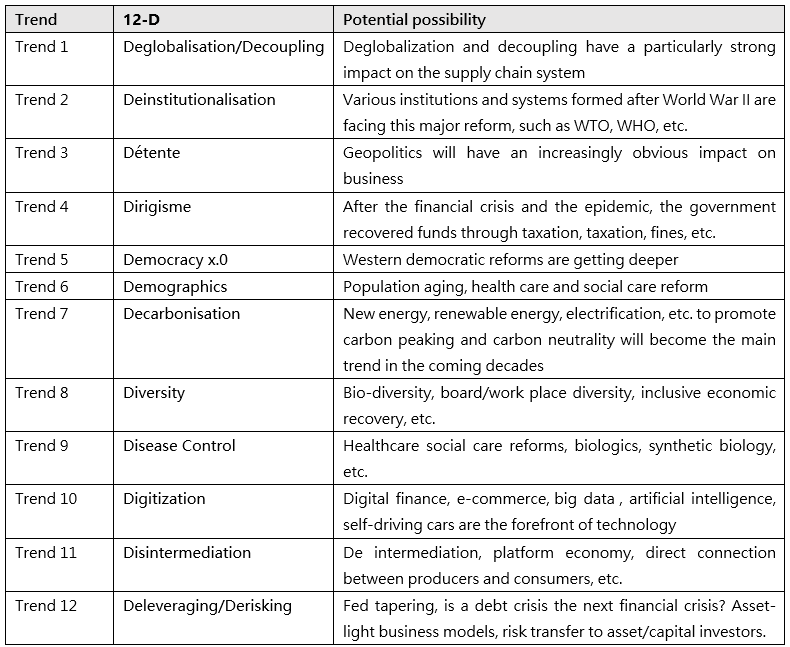

For market positioning, there is a strategy: "Take advantage of the situation and show you the best technique". so that it can best follow the trend. As Lei Jun said: as long as it is on the air outlet, the pig will fly . Don't try to build trend lightly. Of course, if you can create a trend, there will be great success, but after all, very few companies can do it. In the end, we must not go against the trend, which is not in line with the law of things' development and will inevitably be eliminated. For the current trend, we sum it up as 12-D, but we need to combine different industries to get the right trend:

Related Articles:

[Interview with Shih Wing Ching] Challenges and opportunities for Hong Kong companies in High-tech[Change Management] What can we do to face the challenges of the New Normal?

[Greater Bay Area] Industry Clusters for Global Innovation

[CEO Coaching]BEA Interview: Development Opportunities for Hong Kong Banking Industry

[CEO Coaching]Ericsson (HK) Limited Interview:Would Hong Kong lose its competitive edge in 5G era?

Australia: +61 3 9015 4991

Singapore: +65 6850 5067

Hong Kong: +852 3970 1828

Email: cs@apifs.net

Asia Pacific Institute for Strategy (C) 2026