Report on Director Roundtable: "Strategic Planning for 2024"

In a recent Director Roundtable event in August 2023, we gathered insights from about 60 senior executives in Hong Kong, addressing crucial aspects pertaining to their industry in terms of political and economic conditions, market trends, and their own companies' readiness for the future in both technology and organizational aspects. Below is a summary of the findings and insights from the polling questions.

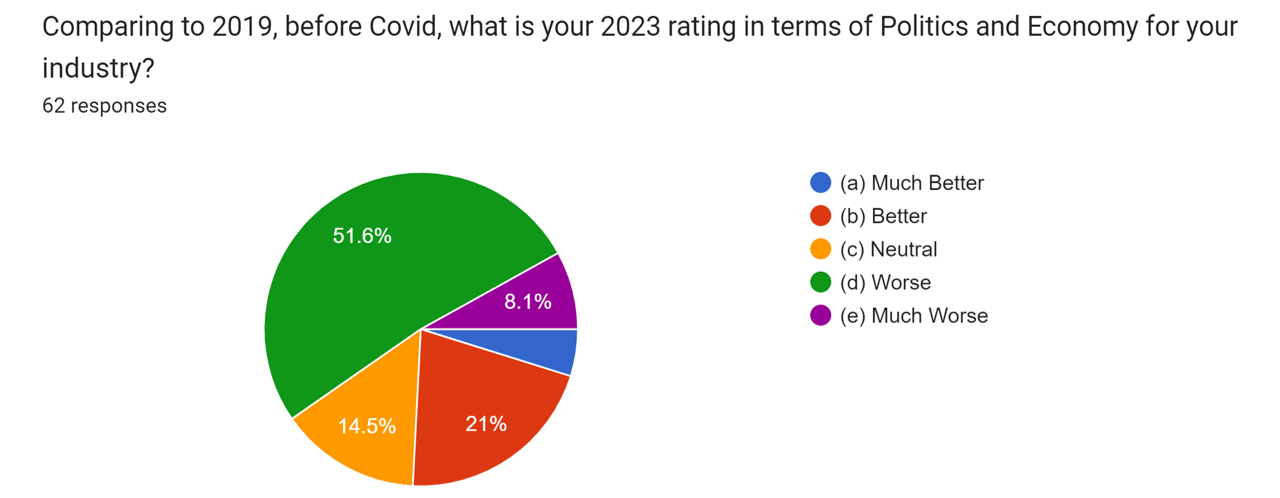

1. Politics and Economy Rating (Comparing 2023 to 2019)

- Positive Outlook (25.8%):

-

- Much Better: 4.8%

- Better: 21%

- Neutral Outlook (14.5%)

- Negative Outlook (59.7%):

-

- Worse: 51.6%

- Much Worse: 8.1%

Insights:

The majority of executives (59.7%) felt that the political and economic environment in 2023 had deteriorated since 2019. Only a quarter (25.8%) had a positive outlook. This could be reflective of lingering economic disruptions and political uncertainties post-Covid.

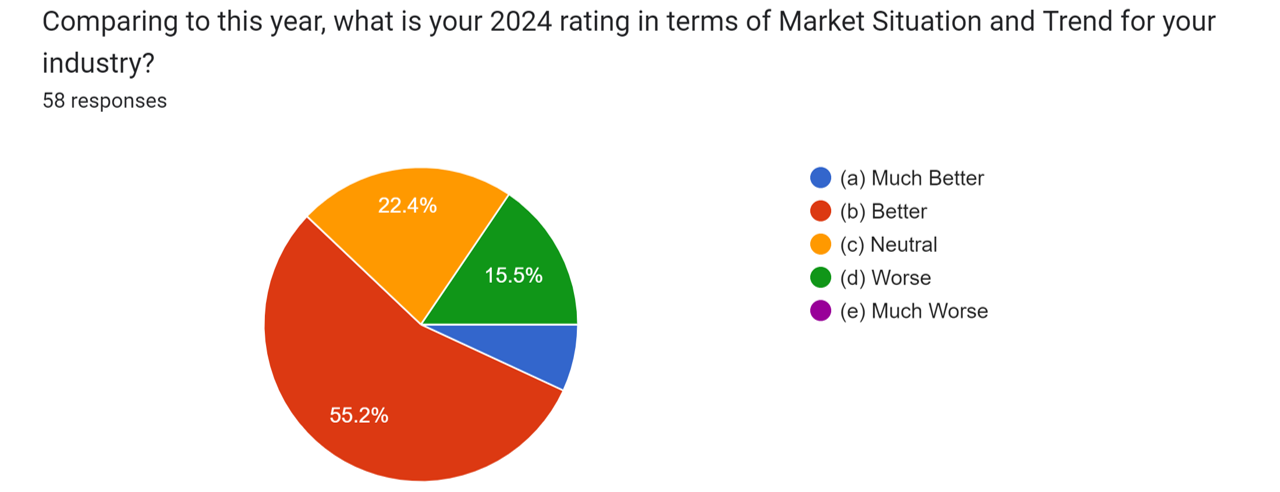

2. Market Situation and Trend for 2024 (Comparing to 2023)

- Positive Outlook (62.1%):

-

- Much Better: 6.9%

- Better: 55.2%

- Neutral Outlook (22.4%)

- Negative Outlook (15.5%):

-

- Worse: 15.5%

Insights:

When looking ahead to 2024, senior executives were more optimistic, with 62.1% expecting an improved market situation. This shows a potential rebound in sentiment and anticipates a more favorable environment in the coming year.

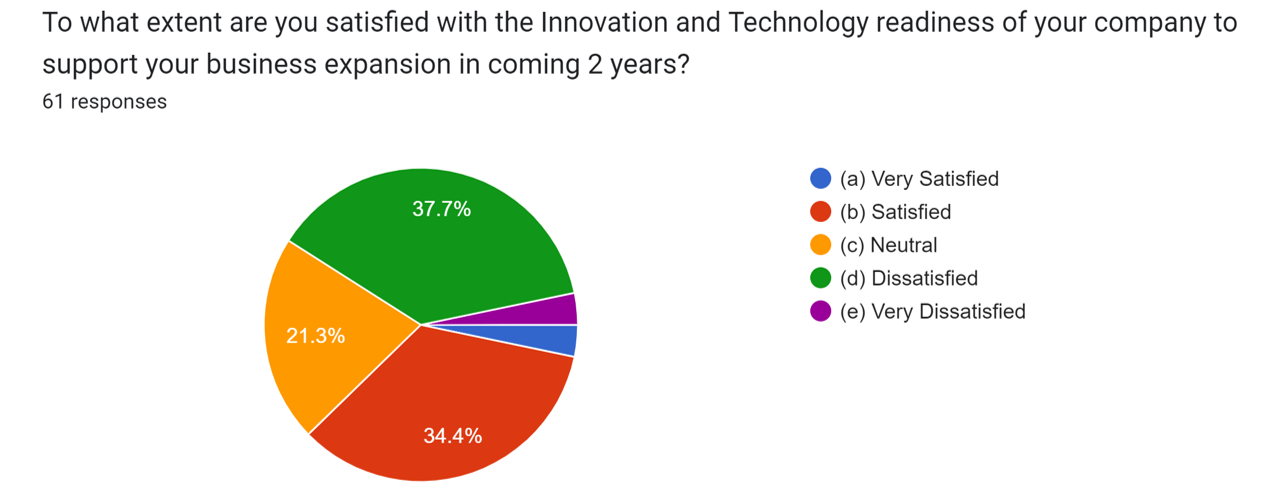

3. Innovation and Technology Readiness for Business Expansion in the Next 2 Years

- Positive Outlook (37.7%):

-

- Very Satisfied: 3.3%

- Satisfied: 34.4%

- Neutral Outlook (21.3%)

- Negative Outlook (41%):

-

- Dissatisfied: 37.7%

- Very Dissatisfied: 3.3%

Insights:

While nearly 38% of executives were satisfied with their company's tech readiness, a significant 41% were not. This underscores the need for continued investment and focus on technological innovation in the industry to remain competitive and prepared for future challenges.

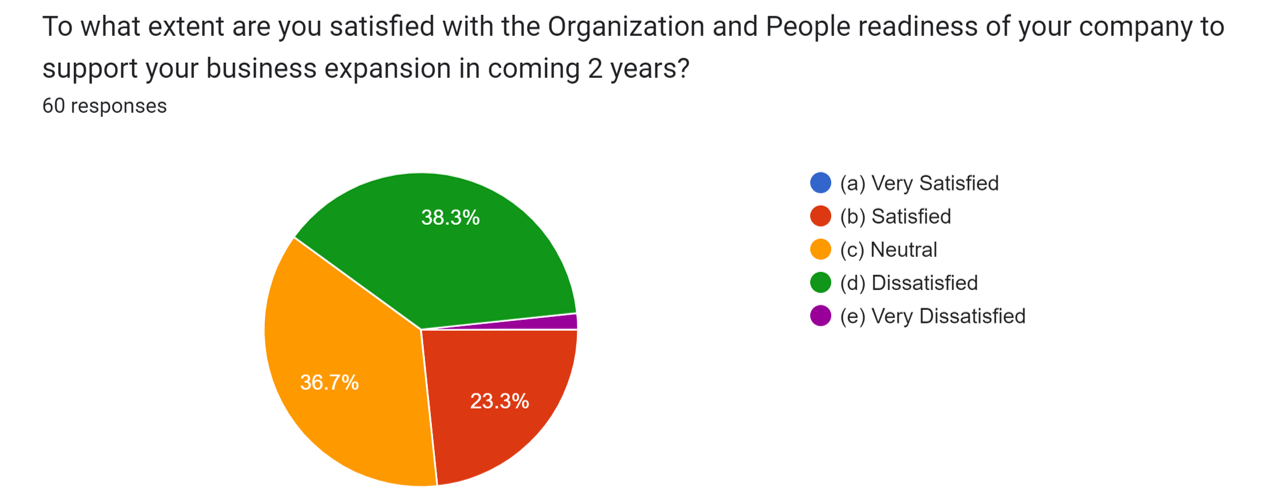

4. Organization and People Readiness for Business Expansion in the Next 2 Years

- Positive Outlook (23.3%):

-

- Satisfied: 23.3%

- Neutral Outlook (36.7%)

- Negative Outlook (40%):

-

- Dissatisfied: 38.3%

- Very Dissatisfied: 1.7%

Insights:

The figures regarding organizational readiness were slightly concerning. With zero respondents being very satisfied and a whopping 40% expressing dissatisfaction, companies need to invest in training, hiring, and organizational restructuring to ensure their teams are well-prepared for the challenges ahead.

Conclusion:

The overall sentiment of senior executives in Hong Kong regarding the political and economic climate of 2023 compared to 2019 leans negative. However, there is a brighter outlook for 2024, suggesting that recovery and growth are on the horizon. While market trends are looking positive, internal assessments suggest companies have substantial room for improvement, especially in the areas of technological innovation and organizational readiness.

Companies should prioritize addressing these internal challenges to ensure they capitalize on the anticipated positive market situation in 2024.

Related Articles:

[Asia CEO Forum] A.I. Leadership at the Majestic Hotel in Kuala Lumpur, Malaysia[Youth I.D.E.A.S. ] 「Economic Development 」Research Series – Tapping into the Economic Opportunities

[Takungpao] Hong Kong Intelligent Manufacturing: Make good use of the advantages of GBA to help

[GBA Strategy] How can companies in the Bay Area and Mainland China leverage Hong Kong "Going Abroad

[HKAS] Hong Kong Apparel Society: 20th Anniversary & Inauguration Ceremony & Business Strategy Award

[Interview with Shih Wing Ching] Challenges and opportunities for Hong Kong companies in High-tech

[China Daily Hong Kong] The shopping festival serves as a touchstone

[GBA Strategy] How can companies in the Bay Area and Mainland China leverage Hong Kong "Going Abroad

[Change Management] What can we do to face the challenges of the New Normal?

[Greater Bay Area] Industry Clusters for Global Innovation

[CEO Coaching]BEA Interview: Development Opportunities for Hong Kong Banking Industry

[CEO Coaching]Ericsson (HK) Limited Interview:Would Hong Kong lose its competitive edge in 5G era?

Australia: +61 3 9015 4991

Singapore: +65 6850 5067

Hong Kong: +852 3970 1828

Email: cs@apifs.net

Asia Pacific Institute for Strategy (C) 2026