[Inflation Strategy] Business strategy for enterprises to ensure profit margin under global inflation

Mr. Joseph Leung & Dr. Mark Lee

Insight Highlight:

- If a company cannot capture the cost change of supply in a timely manner and make new product sales strategies, it is very easy to fall into the dilemma of revenue growth and profit decline.

- In the next five years, the impact of business interruption on company value will increase continually, and only 12% of companies will stand out and become resilient leaders.

- Five challenges in respond to dramatic supply chain changes:Lack of refined monitoring, Turn a blind eye to the cost, Not confident in their product value, The price adjustment cycle is too long, Insufficient overall planning.

- The commercial strategy for the survival and development of an enterprise is to manage forward based on forecasting.

- Two basic price change strategies: "Planned effective price adjustment" based on supply forecasting, "Optimized and adjusted the cost structure" based on demand forecasting.

- Survival Action Strategies of Small and Medium-sized Enterprises: Granular Customer Analysis, Market Segmentation, Upgrade Product/Service, Improve Business Model.。

Under the abuse of the epidemic, enterprises usually face the challenge of fewer orders. However, many enterprises have a surge in business orders, but their profits have declined instead, falling into the dilemma of no money. APIFS conducted an online survey of more than 100 entrepreneurs at the end of 2021. Entrepreneurs generally feedback that 2021 will be greatly affected by inflation. Among them, 64% of entrepreneurs believe that material costs have increased the most, and 19% of entrepreneurs believe that labor costs have increased the most. Some entrepreneurs reported that the cost of clothing materials increased by more than 35%, and the labor cost increased by 10%. In this case, if a company cannot capture the cost change of supply in a timely manner and make new product sales strategies, it is very easy to fall into the dilemma of revenue growth and profit decline.

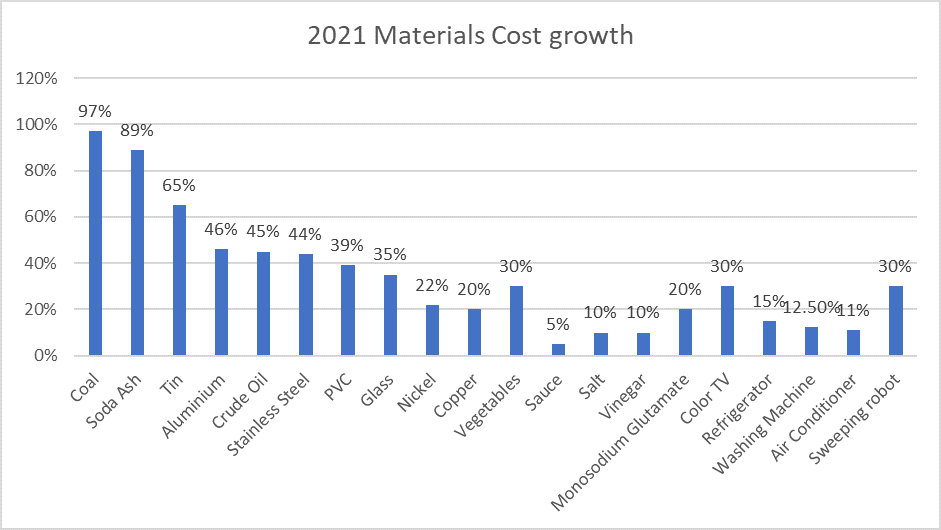

In industrial production, as early as July 2020, the data showed that the global raw materials cost of cold rolled steel increased by more than 200%, the container cost also increased by more than 150%, and even the more commonly used plastic raw materials also increased by 20%. Wu Xiaobo, a famous Chinese financial writer, comprehensively summarized the prices of core commodities in 2021 in his new year's speech in 2022: almost all commodity prices are rising in 2021: Coal rose 97%, Soda Ash 89%, Tin 65%, Aluminum 46%, Crude Oil 45%, Stainless Steel 44%, PVC 39%, Glass 35%, Nickel 22% and Copper 20%.

The value chain has been greatly impacted, facing interruption and reconstruction

《2021 global supply chain and operational flexibility report 》released in June 2021 by The World Economic Forum (WEF) showed that, 76% of executives said COVID-19 was an important interference factor. And emerging technologies, geopolitical tensions, trade barriers, political uncertainty, social injustice and climate change also caused the frequency and intensity of supply and the disruptions of demand side. It will continue to shake the balance of the global value chain. Executives said that they now spend more than 75% of their time on challenges related to resilience. In the next five years, the impact of business interruption on company value will increase by 15-25%, and only 12% of companies will stand out and become resilient leaders.

The figure of 12% seems very terrible. Professor Nitin Nohria, Dean of Harvard Business School, found that only 9% of companies have become stronger than before after stepping out of the slowdown in the last financial crisis. So, the current situation is not as bad as imagined. With the gradual diversification of the global supply chain and the continuous support of digital innovation technology, it may be easier to reconstruct the value chain than before. However, under the superposition of large inflation and epidemic situation, entrepreneurs need to speed up their own response.

A packaging supplier in the United States saw a 20% increase in raw materials costs in the past 12 months. At the last moment, it could not withstand the cost pressure and pushed the price of its products to increase significantly. However, neither the sales system nor the customers were sufficiently prepared for the price increase. As a result, double-digit market share was lost, and the leadership team was panicking, and the company's profit margins were worse than ever.

Five challenges in respond to dramatic supply chain changes

Entrepreneurs are now seeing the impact of supply chain changes, especially raw material inflation. However, many entrepreneurs seem to be " incapable of action " in the process of running enterprises. We summarize the markup strategy to deal with cost changes and find that companies generally face five major challenges:

- Lack of refined monitoring: Taking the manufacturing industry as an example, the factory production department is more likely to look at the entire bill of materials, and the overall cost of the entire BOM may increase by only 5%-10%. But if it goes deep into specific materials, some materials may have increased by 1-2 times. The purchasing department is more based on the purchase plan to ensure that the materials can be in place, and finally compare the lowest price. Therefore, there is no early warning of cost changes from detailed analysis to promote the appropriate price adjustment of products.

- Turn a blind eye to the cost: The marketing or sales pay more attention to the total sales revenue rather than the unit price of some orders. Even if they see the cost rise, they are unwilling to transfer the cost to the product sales price, because the price increase often makes them more difficult to make orders, so they turn a blind eye to whether the cost increase drives the price of the product.

- Not confident in their product value: When it is clear that the cost is rising and the product needs to be increased in price, the sales often send negative information inward and are unwilling to talk about the price increase. On the one hand, they are worried that there is not enough reason to increase the price, which will affect the continued cooperation with clients. On the other hand, they also think that price increase and value increase should be equal, which will push the product to increase the cost. However, they add the value of " gild the lily", resulting in greater cost waste.

- The price adjustment cycle is too long: It may be half a year from the cost is perceived to rise to the decision to increase the price. However, when the price is increased, it is found that the materials cost has fallen again, and the customer does not accept the new price, and the cost is borne by itself.

- Insufficient overall planning: On the proposition of price increase, the exact amount of price increase needs to be supported by a large number of complete data, especially forecasting data. However, many enterprises lack forecasting data. Because ERP system processes transaction data rather than forecasting data, the pricing depends more on the perceptual feedback of sales and then "pat the head".

When the supply chain is relatively stable, enterprises seek the superiority and differentiation of products to obtain the competitive market. As Drucker said, enterprises have only two basic functions, namely innovation and marketing. In the case of large inflation, the uncertainty of the supply chain directly affects the survival of enterprises, so the response to the change of the supply chain has become one of the primary tasks of enterprise managers, and the operation has returned to a very important position, while the prediction of the future has become the top priority of all works.

Taking chip shortage as an example, if the enterprise has strong purchasing ability and obtains sufficient chip supply, the market share of the product can be significantly improved. Because its own supply increases, the opponent's supply will decrease accordingly, and the market share will be reversed once and for all. One of the most obvious examples is the lack of chips in Huawei's mobile phones, resulting in a sharp decline in their mobile phone market share.

Business strategies for enterprise survival and growth in the new economic era

Facing high inflation, the Federal Reserve changed its previous view that "inflation is temporary". At the monetary policy meeting in December 2021, Federal Reserve Chairman Powell said that the reason for the upward inflation was not caused by short-term factors, and high inflation would exist for a long time. In this case, there is a high probability that the Federal Reserve will continue to tighten monetary policy, and various costs will remain high, and it is likely to fall into stagflation.

In this case, the commercial strategy for the survival and development of an enterprise is to manage forward based on forecasting. The business strategy needs to evaluate the income, profit, market share and price in combination with the enterprise itself, integrate the supply and demand forecast, from product mix (profit products / scale products / old and new products, etc.), channel mix (traditional channels / electronic channels / mixed channels, etc.) and resource mix (providing solutions / providing standard products / integrating ecological capability services) to adjust strategies.

- Revenue: can we give up the scale of revenue to make profits in short-term?

- Profit: is it sufficient funds to give up profits, or is it must to ensure profits due to lack of funds?

- Market share: is there enough market foundation to continue to expand the market share, and then distance from the opponent?

- Pricing: is the price insensitive and the differentiation of products / services enough to prevent market loss due to price rise?

When the epidemic broke out in 2020, an entrepreneur was worried that there would be no order, so he signed a one-year contract at a "fixed price" as early as the beginning of the year. As a result, he did not worry about business, but he lost nearly 40 million at the end of the year. Obviously, this is not without prediction. The entrepreneur made advance order forecasting for the epidemic, but he did not expect that the increase in material costs would lead to more and more losses. Therefore, "forward management based on forecasting" must be the company's overall action: the procurement department needs to diversify procurement channels to ensure the optimal price supply. The marketing department needs to eliminate the self-obstruction of "price increase", and obtain benefits from the downstream to make up for the cost growth of the upstream. The R&D department needs more insight into the key needs of customers, rather than "gilding" the needs of customers. The financial and operation departments need to provide business strategies from the cost forecasting.

When the supply cost changes, the price of the product also responds to the change, which is very reasonable. There are two basic strategies:

- "Planned effective price adjustment" based on supply forecasting: it is a three-dimensional action, rather than just looking at changes in raw materials and labor costs. It also needs to pay attention to logistics prices, or electricity prices, oil prices, or coal prices. For some contracts that are strongly related to the price of social commodities, you can adjustment agreement directly related to corresponding price, or even directly executed as an "open contract".

- "Optimized and adjusted the cost structure" based on demand forecasting: re-examine the key needs of customers, eliminate the cost of "over-engineering" in the past, and even "re-engineering" the products to adjust the cost from itself to deal with the inflation of other supplies.

Survival Action Strategies of Small and Medium-sized Enterprises

For small and medium-sized enterprises, in the coming two years, unless they are in the high-growth industry, it is basically difficult to develop, and more about to survive. A previous study by Professor Nitin Nohria, Dean of Harvard Business School, pointed out that nearly 17% of enterprises failed to survive the crisis, and finally went bankrupt and were acquired. Under the big inflation, lack of bargaining power and capital capacity have become particularly prominent in small and medium-sized enterprises. Their survival strategy is also: forward management based on forecasting, but it is different from large enterprises.

With relatively limited customer resources, it is more necessary to carry out Granular Customer Analysis, from the customer's access channels, consumption ability, profit level, pressure resistance, etc., to capture the most suitable customer group to adjust the price.

In the relatively priority market areas, it is more necessary to accurately conduct Market Segmentation. Large companies usually emphasize the 20-80 analysis of SKU to avoid the "long tail". Small and medium-sized enterprises need to constantly supplement new products and ensure that the market segments are met, and cannot rely too much on old products.

With limited capital investment, it is more necessary to accurately Upgrade Product / Service to meet the market segments and continue to create product differentiation to maintain long-term profit growth.

On the basis of accurate customers, markets and products, integrate channels and ecological supply capabilities to further Improve Business Model. On the one hand, you should strengthen brand assets. On the other hand, you should build a three-dimensional supply and sales network, and even consider the integration of B2C and B2B, in which digital technology is one of the important breakthroughs.

Author: Mr. Joseph Leung & Dr. Mark Lee

Issue: January 2022

Related Articles:

[Digital Transformation] How to strategically lead the digital transformation of enterprises?[High-growth Strategy] Enterprise high-growth portfolio model and 12 growth opportunities

[Interview with Shih Wing Ching] Challenges and opportunities for Hong Kong companies in High-tech

[Change Management] What can we do to face the challenges of the New Normal?

[Greater Bay Area] Industry Clusters for Global Innovation

[CEO Coaching]BEA Interview: Development Opportunities for Hong Kong Banking Industry

[CEO Coaching]Ericsson (HK) Limited Interview:Would Hong Kong lose its competitive edge in 5G era?

Australia: +61 3 9015 4991

Singapore: +65 6850 5067

Hong Kong: +852 3970 1828

Email: cs@apifs.net

Asia Pacific Institute for Strategy (C) 2026